Contents

Categories

The back-to-school shopping tradition

The majority of respondents (71%) said they would be participating in back-to-school shopping before the school year begins. Whether it’s stocking up on new supplies, updating wardrobes, or simply getting organized, this time of year is marked by a whirl of consumer excitement. Meanwhile, 29% of respondents said they do not take part in this tradition, either due to a lack of need or preferring instead to rely on existing supplies.What’s filling shopping carts this year?

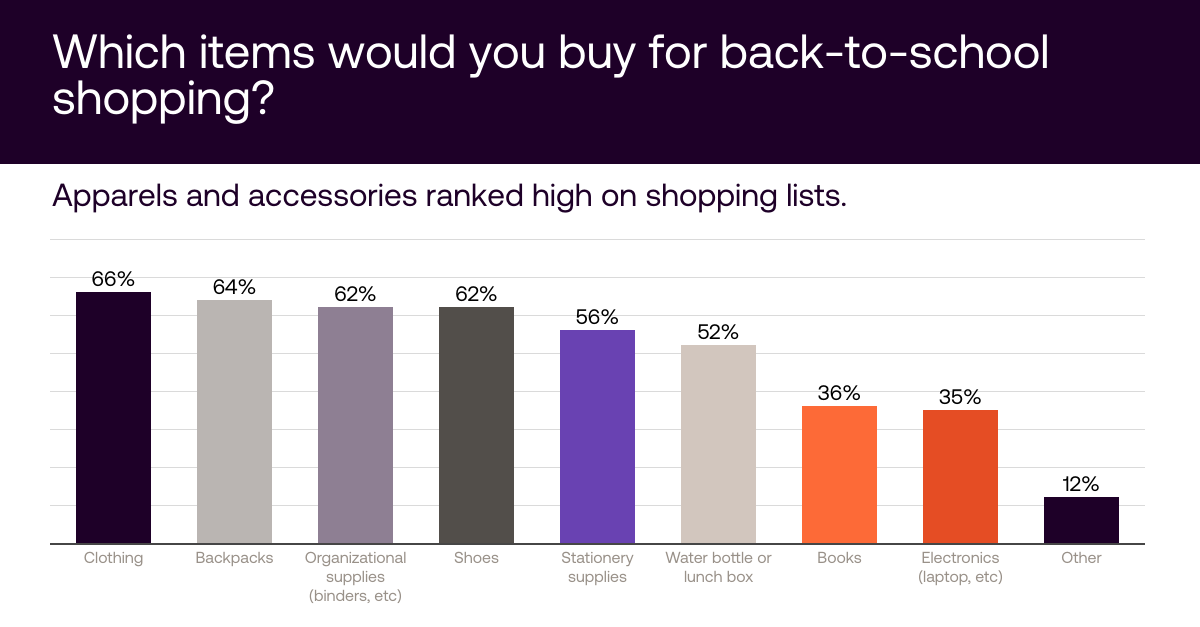

When it comes to what people have on their back-to-school shopping list, apparels and accessories ranked high. Top items that shoppers were after included clothing, backpacks, organizational supplies, and shoes.

How much are people spending?

Perhaps coming right out of holidays, budgets seem to reflect slightly on the lower end of things, with 28% not planning to spend anything at all. When it comes to projected expenditures, there is a significant variation in how much people plan to spend on back-to-school shopping. The data reflects a fairly balanced level of spending habits, with a significant portion of shoppers planning to spend relatively modest amounts, while a smaller group prepared to splurge more heavily.

The data reflects a fairly balanced level of spending habits, with a significant portion of shoppers planning to spend relatively modest amounts, while a smaller group prepared to splurge more heavily.

Where are people scoring the best deals?

As for where consumers prefer to do their back-to-school shopping, preferences are almost evenly split between traditional department stores and online marketplaces like Amazon, with 63% of respondents favoring both platforms. While online shopping continues to grow in popularity, the results prove that brick-and-mortar stores remain a key destination for those who value in-person shopping experiences.

While online shopping continues to grow in popularity, the results prove that brick-and-mortar stores remain a key destination for those who value in-person shopping experiences.

The power of advertising: What’s grabbing consumers’ attention?

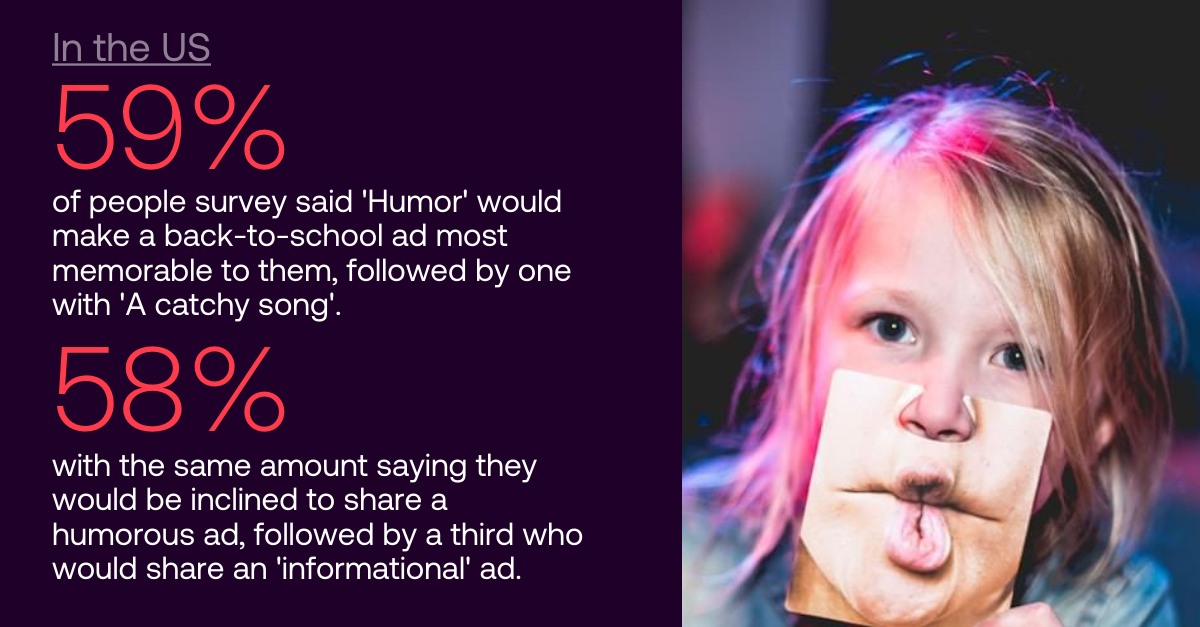

What type of ‘back-to-school’ advertisements float your boat? We looked into what consumers found memorable and which they were most likely to share with friends and families. Unsurprisingly, humor played an important part to both of these requirements and played the biggest impact in influencing consumer behavior. Humor 59% was the most effective tool when considering what makes an ad most memorable, followed by a catchy song (45%), and iconic characters (29%). Emotional resonance, information, and the presence of famous influencers or celebrities also play a role, though to a lesser extent. Our survey also uncovered that sharing an ad with friends or family was most likely to happen if the ad is humorous (58%), informative (33%), or features a catchy song (31%).

TV, social media, or websites?

Where do people most prefer to encounter back-to-school ads? Having ads pop up on the telly was a resounding winner for almost half of the people surveyed. This was followed by social media platforms like Facebook (19%) and YouTube (14%). Interestingly, platforms like Instagram, TikTok, and Twitter were much less preferred mediums for back-to-school advertising, indicating that more traditional and widely-used media still hold sway. Or perhaps that most people do not like to be reminded of going back to school while browsing social media.

Do you plan to shop at back-to-school sales this year? What items will you be reaching out for either in-store or online?

Interestingly, platforms like Instagram, TikTok, and Twitter were much less preferred mediums for back-to-school advertising, indicating that more traditional and widely-used media still hold sway. Or perhaps that most people do not like to be reminded of going back to school while browsing social media.

Do you plan to shop at back-to-school sales this year? What items will you be reaching out for either in-store or online?