For over 400 years now, people in the United States have rounded off November by celebrating Thanksgiving, an annual excuse to eat turkey, watch football, and spend time with loved ones.

More recently, though, Thanksgiving has been immediately followed by Black Friday, which in turn has been followed by Cyber Monday — a mammoth four day long shopping frenzy.

Despite relative economic uncertainty across the globe, Forbes reported that online sales during Black Friday, Cyber Monday were up 7.8% in 2023 on 2022, with Americans spending over $12 billion.

Using CintSnap — a way to survey individuals and understand opinions quickly — we conducted a poll with approximately 300 people in the US to examine consumer attitudes toward a long weekend that now combines deep-rooted traditions with shopping. Lots of shopping.

Traditions old and new

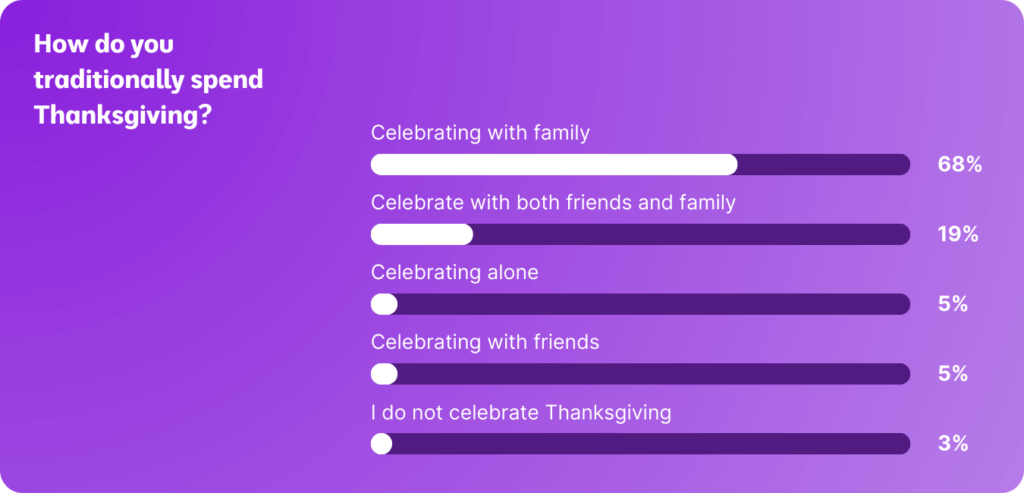

Family comes first for over two thirds of respondents, with 67% of them indicating that they’ll be spending Thanksgiving with their nearest and — hopefully — dearest, while around a fifth are planning on seeing friends and family on the biggest Thursday across the US.

And despite Black Friday and Cyber Monday being an undeniably massive deal for retail and consumers alike, Cint respondents still unanimously stated that Thanksgiving is more important to them, with a whopping 77% giving it the nod over Black Friday and Cyber Monday.

That said, nearly half the respondents told Cint that there’s been something of a merger between the centuries old celebration and the relatively modern one. With 46% of survey-takers going shopping in person with family over Black Friday and Cyber Monday, the sales have clearly become part of their seasonal traditions.

Hey, big spender

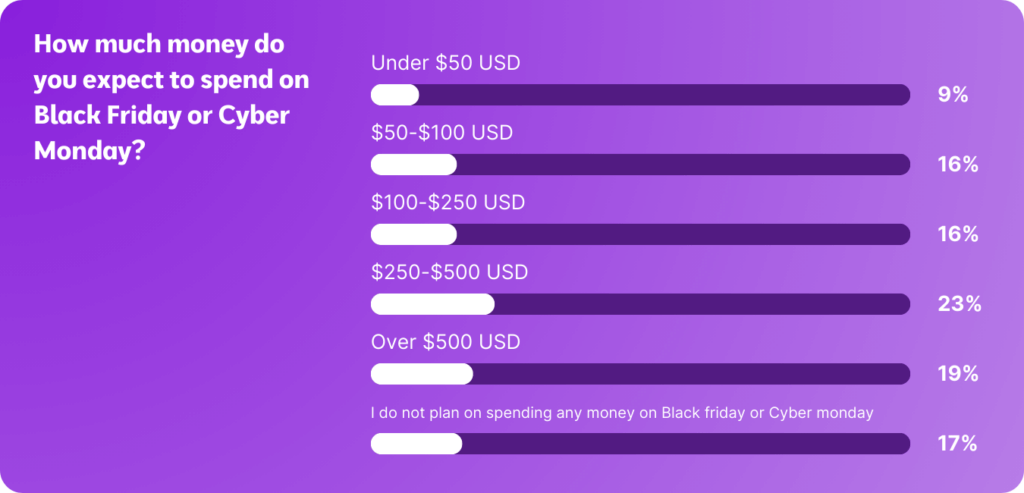

There’s evident enthusiasm for Black Friday and Cyber Monday amongst our respondents: three quarters of those surveyed consider themselves likely or highly likely to make purchases on those days. Only a smidgen over a tenth indicated that it’s unlikely or highly unlikely that they’ll be participating in the sales.

The respondents who will be spending on Black Friday and Cyber Monday are set to shell out considerable sums as part of the extended holiday. Just under a quarter of surveyed respondents are setting aside between $250 to $500, and around a fifth will be spending over $500.

When it comes to assessing what bargain-hunting Americans will be eyeing up when prices are slashed and splashing out feels a bit more doable, our survey shows that the majority of respondents are planning on getting on top of things by starting on their holiday shopping.

Consumer electronics, household items, and books and games also proved popular. 25% of respondents said they’ll be looking out for good deals on seasonal apparel, and just over a fifth will be pampering their pooches by taking a punt on cut-priced pet care items.

Let’s get physical

When it comes to scoping out the best deals on Black Friday and Cyber Monday, 34% of our respondents gravitate towards making online purchases. 28% are going to make the effort to wander around a brick and mortar store over the long weekend, and 27% will be dividing their spending between the internet and physical shops.

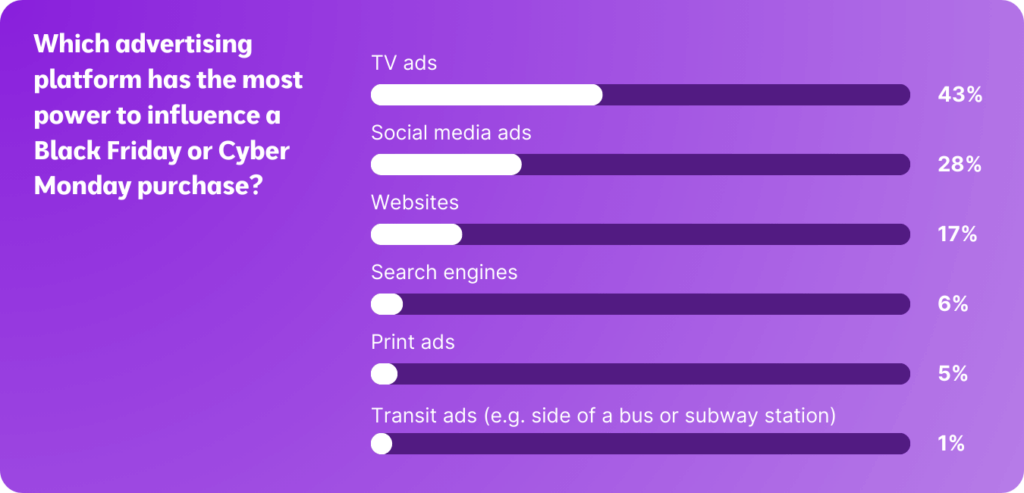

Despite the internet’s slight advantage when it comes to retail sales over Black Friday and Cyber Monday, the power of TV cannot be understated when it comes to understanding what sways consumers in 2024.

Just under half of respondents (43%) note that ads broadcast on television have the most power to influence their buying decisions. Social media platforms are playing an increasingly important role in this area, with 28% of those surveyed saying that ads served to them on platforms like Facebook and TikTok drive them towards purchases.

Conclusion

The combination of Thanksgiving, Black Friday, and Cyber Monday has become as US as apple pie, the Super Bowl, and David Letterman. With billions upon billions of dollars to be spent, it’s also a dream come true for the retail industry, who get a big blowout weekend just before Christmas rolls around.

Has Thanksgiving become a good excuse to go shopping? Or do you keep things cozier and stay at home with a turkey?

Join the conversation on our LinkedIn page.

Methodology

A ‘CintSnap’ is a snapshot into the minds of general consumers. The data featured was pulled using the Cint platform and leverages Cint’s programmatic research tech. A census demographic of approximately 300 people in the United States were surveyed for each question within a 3 hour window on 13 November, 2024.

Cint’s research technology helps our customers to post questions and get answers from real people, in real time – and to use these insights to build business strategies, publish research, and accurately measure the impact of advertising efforts. Find out more here.